What is Artificial Intelligence?

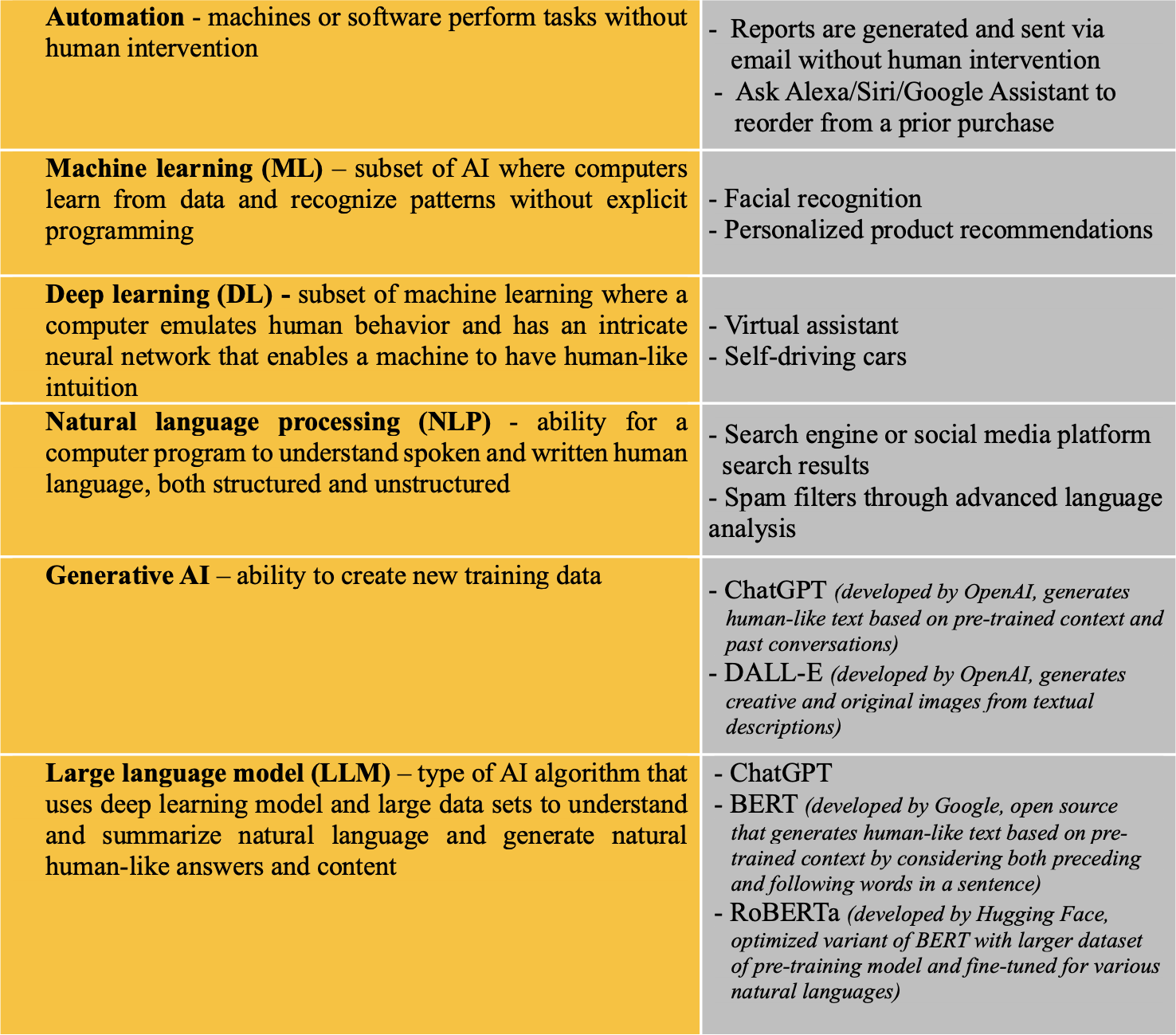

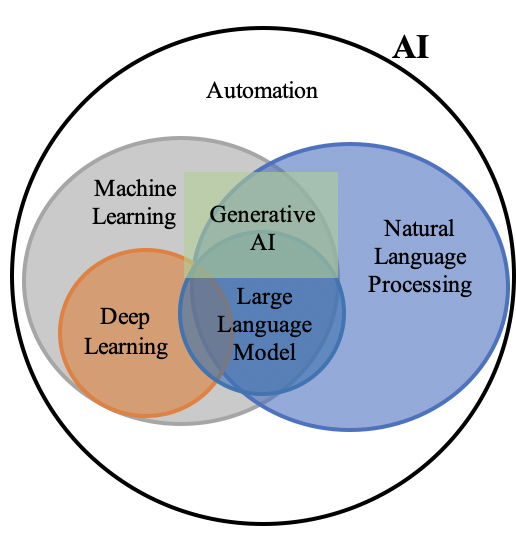

Artificial intelligence (“AI”) is where machines autonomously execute tasks that require human intellect – comprehending speech, discerning objects, and making complex decisions. AI is a multi-faceted term encompassing various concepts, described in more detail below.

Data: The Bedrock of AI

If AI was to be described using a single word, it would be Data. The core of AI lies in scrutinizing vast data sets, extracting insights, and fostering informed decision-making. At the end of the day, companies are trying to use data to be more efficient and increase profit, necessitating more robust data centers and platforms to process, compute, and store data.

AI’s Evolution: From Narrow to Broad Intelligence

Artificial intelligence traces back to the dawn of computers when computer logic solved simple problems in the 1950s. The earliest indication of generative AI’s potential is MIT’s ELIZA in the mid-1960s, where it simulated therapist-like conversations and answered questions. In the late 1970s to 1990s, expert computer systems were used to replicate human decision trees. In 1997, IBM’s Deep Blue stunned the world when it became the first computer to defeat world chess champion Garry Kasparov in a six-game match.

AI has continued to evolve, progressing from narrow (focused on one area) to broader intelligence (proficient in multiple domains). Although it has been decades in the making, the limitation for AI has been data, networks, and hardware as AI relies on massive data sets, large networks, advanced algorithms, and hardware innovations (e.g., processing speed, memory, big data, speech recognition, machine vision). Recent breakthroughs in transformers and data model parameters in addition to cheaper computing costs over the last few years have contributed to the generative AI landscape today. The current LLM is built on over 1 trillion parameters, which is 9,000x more than the 110 million parameters used by Google researchers’ BERT language model in 2018.

With deep learning and current LLM, we are one step closer towards artificial general intelligence where it can also train itself using existing data and broadly generate and create original, creative content (e.g., text, images, music, computer, writing, plans/recommendations).

Separating Hype from Reality

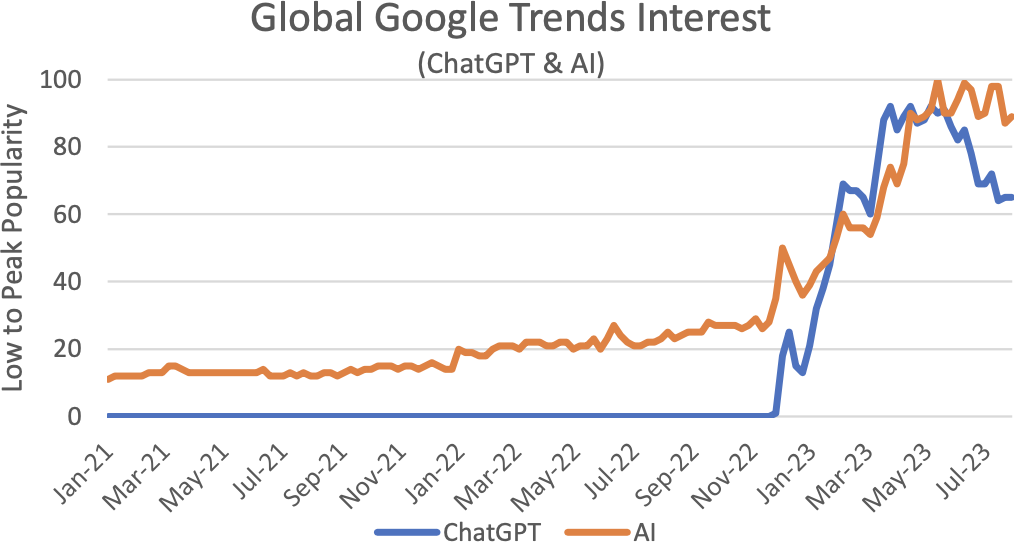

The low-key release of ChatGPT by OpenAI in November 2022 drove interest in AI to new heights and the AI hype is still ongoing. ChatGPT interest peaked in the second quarter of 2023.

Yet, AI has spanned decades and has been marked by incremental enhancements in efficiency and liberation from routine tasks through time and innovation towards creation. Machines have been used to improve efficiency since the industrial revolution. Companies and humans seek to further free themselves through machines so the fundamental drive for efficiency and AI is here to stay. AI’s core contributions endure – enabling industries and companies to operate more efficiently and augmenting decision-making with data-backed insights. AI is already used for less complex tasks that are

addressable by rules. Companies that don’t harness AI face a cost disadvantage to those that use AI and particularly in the software industry, the disparity could reach up to 50% of cost.

Over the past decade, AI has garnered interest from major technology companies and the leading public strategic acquirers of AI since 2017 according to Pitchbook are Apple, Accenture, Microsoft, Facebook, Cisco, ServiceNow, Intel, IBM, and Oracle. Microsoft also deepened its partnership with OpenAI in January 2023 by making an additional $10 billion investment in OpenAI.

Despite AI’s decades-long enhancements, it remains very probabilistic and prone to inaccuracies. AI can serve as a starting point but cannot replace human expertise and research as it often takes information out of context and inaccurately references sources.

Future of the AI Market

Bloomberg Intelligence estimates that the total addressable market for generative AI is set to reach $1.3 trillion by 2032, presenting a growth trajectory of 40% per year from the $40 billion in revenue in AI-related hardware, software, and services today. AI currently accounts for 1% of the total technology spend and is projected to burgeon to 12% by 2032. Technology giants like Amazon, Facebook, Google, and Baidu have recently launched AI applications. The allure of AI, with its potential to automate repetitive tasks and boost efficiency, resonates across various industries as new companies build on top of and harness the computing power and cloud infrastructure to create AI applications and services. Some industry verticals like healthcare and legal are primed for AI and are likely to be great beneficiaries of AI-driven transformations.

Training and using AI requires significant resources in computing hardware, computing power, connectivity network, semiconductor chips, power supply, cloud infrastructure, data storage, network switches and cooling facilities. Achieving economics of scale requires 100,000x greater improvement in servers, network, compute power, storage units, data centers, and fiber optics but investments to date have mainly focused on software so hardware has been under-invested. These hardware types require space and real estate. In its 2023 Global Data Center Outlook, JLL estimates that the hyperscale data center market will grow at 20% per year to address AI needs.

Alongside AI expansion, there will be an increased need for

- Data infrastructure encompassing real estate for servers, routers, and other technology hardware, robust fiber connectivity network to move the data and enabling technologies like semiconductor chips which can dramatically speed up computational processes for learning, such as Nvidia Graphics Processing Unit (GPU).

- Infrastructure-as-a-service focused on AI which can provide a convenient scalable way to train models and LLM, e.g., Oracle’s GPU as a service offering.

- AI platforms that are cloud software platforms, e.g., a personal AI writing assistant like OthersideAI.

- Data analytics companies to ensure AI/ML data is accurate and actionable.

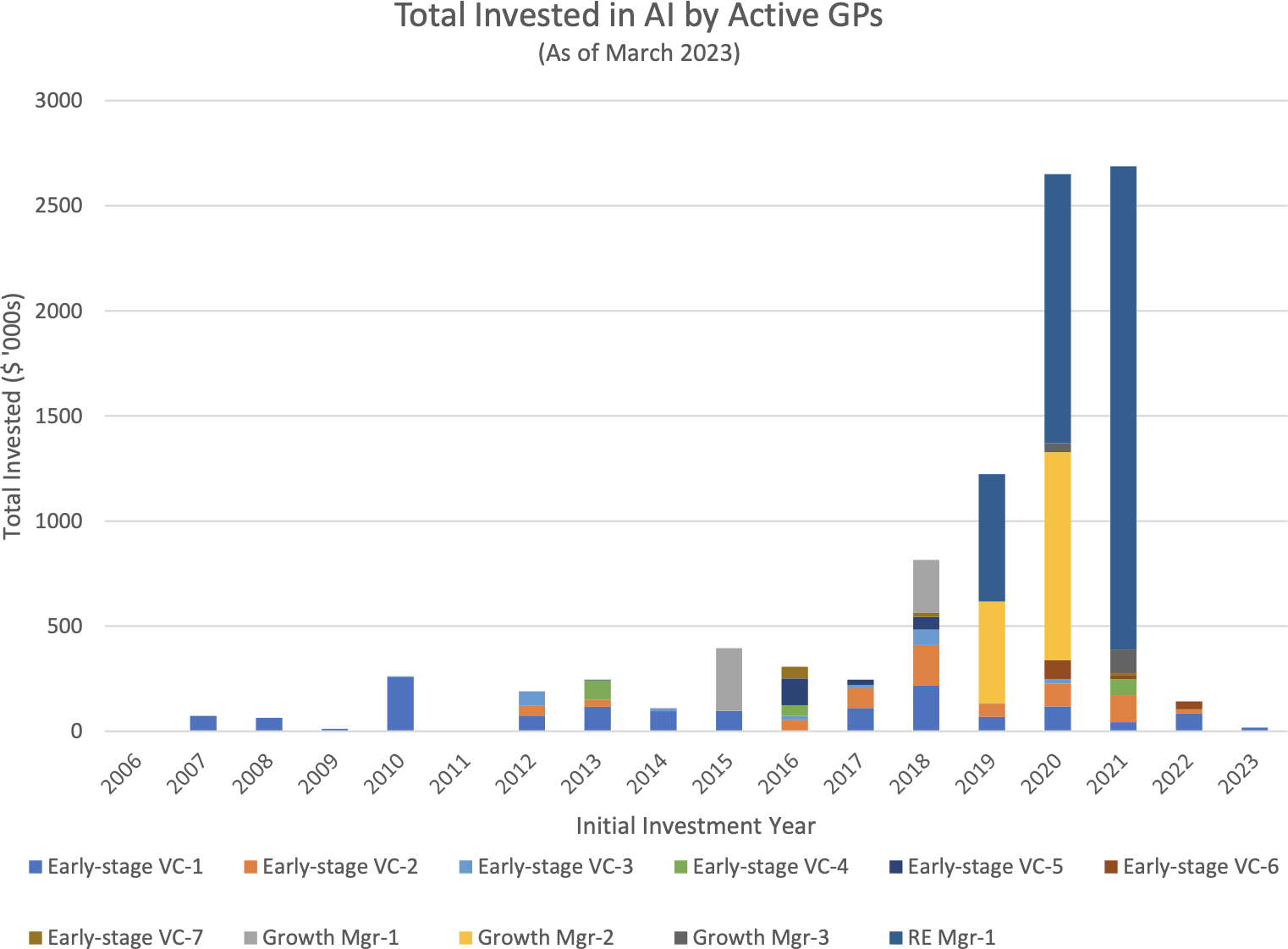

Sentinel Trust’s Ongoing AI Journey

Sentinel Trust has invested in AI for over 15 years and has made approximately 100 investments to date. Embarking on this journey early, we, alongside one of our long-term early-stage venture partners, started investing in the theme early in 2006-2007 and have been an active, repeat investor since. We have followed the AI trends for years with seven of our early-stage venture partners, three growth investors, and one digital infrastructure-focused real estate manager and are well-positioned to capture the long-term opportunities and growth potential in AI.

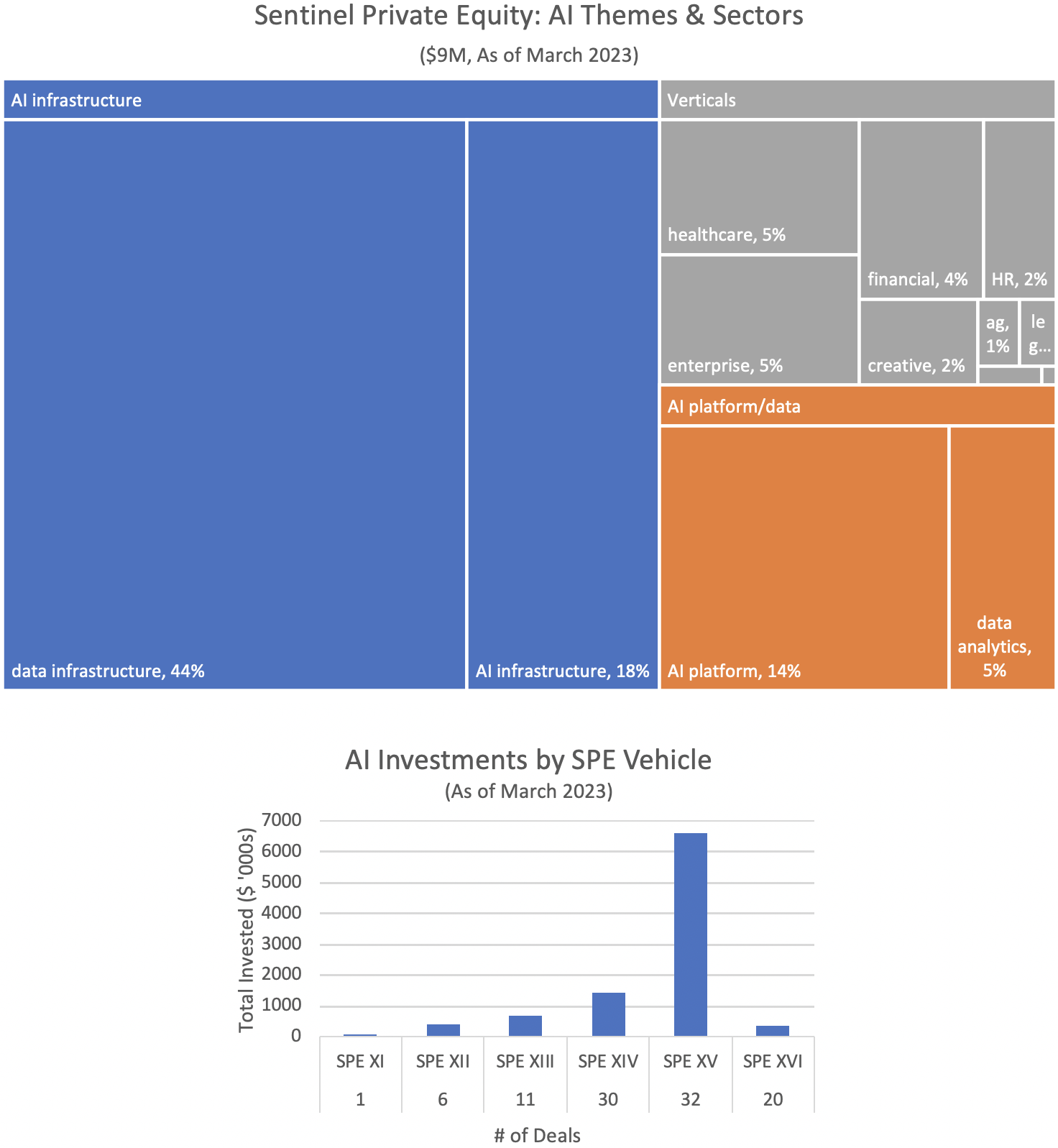

As of March 2023, Sentinel Trust’s Private Equity (“SPE”) program has invested over $9 million in AI, focusing primarily on a picks-and-shovels approach to infrastructure (hardware and computing power foundation) and AI platforms/data (tools for deploying and managing data, models, training, and testing). SPE is invested in data center real estate and operators, fiber connectivity networks, cloud-based AI operating infrastructure and models, AI/ML software platforms, AI/ML data analytics and quality assurance solution, and AI applications in various end markets including healthcare, financial services, enterprise software, human resources, creative industry, legal, and agriculture. All SPE vintage fund of funds have exposure to AI, and we remain optimistic about the opportunity set today.

Sentinel Trust and our clients also have exposure to AI through investments in large public technology companies that are acquirers of AI in addition to public companies that are active participants in the AI domain such as Amazon, Google, Nvidia, Arista Networks, Taiwan Semiconductor, ASML, Snowflake, and SAP. We expect to continue to make additional investments in AI as AI reshapes our interaction with technology and the world.

Closing Thoughts

In conclusion, AI is here to stay. After decades of progress, we expect AI to further human productivity so that human judgment focuses on areas of greater, durable value creation. Like other technological progress through history, it’s a transformational journey that will further enhance human productivity, albeit with ongoing debates about its impact on various aspects of society including but not limited to jobs, ethics, security, privacy, and accuracy of information. In addition, society continues to be concerned that AI and machines may take over the world like it did in The Terminator or The Matrix.

It is still too early to tell who the winners will be and what applications are likely to scale. It is also up for debate on whether it helps or hurts humans and their jobs – as on one hand, AI has helped lawyers review five non-disclosure agreements in 26 seconds compared to taking the average lawyer 92 minutes to review without AI help. Hollywood writers and the creative industry are on strike seeking protection against AI as they are afraid of losing their jobs to machines. Thinking back to Microsoft Excel and how it changed the way businesses operate – Microsoft Excel saved companies days of time managing huge amounts of data and formulas no longer needed to manually calculate using a calculator. Accountants, bookkeepers, and corporate roles had to evolve to learn to interpret massive amounts of data in a slightly different way.

AI, today, is the next iteration of technological progression.

Download the AI Whitepaper here.

This material is published solely for the interests of clients and friends of Sentinel Trust Company, L.B.A. and is for discussion purposes only. The opinions expressed are those of Sentinel Trust Company management and are current as of the date appearing on this material and subject to change, without notice. Any opinions or solutions described may not be suitable for investments nor applicable to all scenarios. The information does not constitute legal or tax advice and should not be substituted for a formal opinion. Individuals are encouraged to consult with their professional advisors.

The material is not intended to be used as investment advice, nor should it be construed or relied upon, as a solicitation, recommendation, or any offer to buy or sell securities or products. Any offer may only be made in the current offering memorandum of a fund, provided only to qualified offerees and in accordance with applicable laws. Each type of investment is unique. This material does not list, and does not purport to list, the risk factors associated with investment decisions. There can be no assurance that any specific investment or investment strategy will be profitable and past performance is not a guarantee of future investment results. Before making any investment decisions, you should carefully review offering materials and related information for specific risk and other important information regarding an investment in that type of fund.

Information derived from independent third-party sources is deemed to be reliable, but Sentinel Trust cannot guarantee its accuracy of the assumptions on which such information is based.