Todd Burchett and Sentinel Trust’s Investment team review the markets in 2023 and provide an outlook for 2024.

Please read the full text below or download the PDF version.

Executive Summary

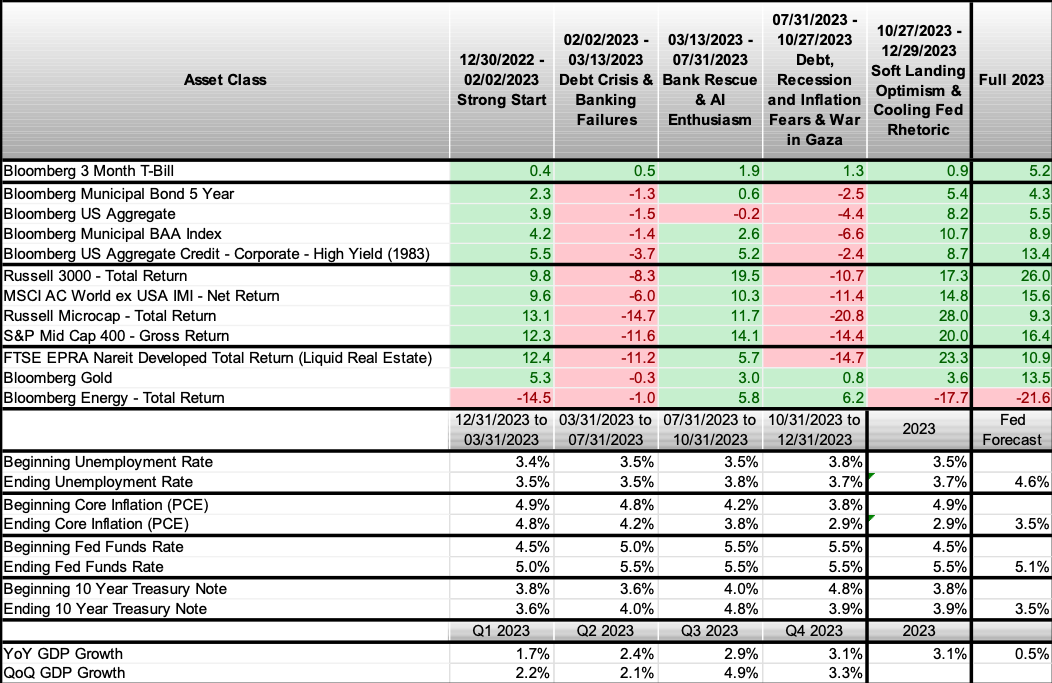

- Despite a difficult 2022 that ended with near record lows in sentiment, markets rebounded strongly in 2023 albeit with numerous whipsaws. In 2023, we saw some of the largest banking failures in history, US debt ceiling and downgrade concerns and a new war in Gaza. Yet, economic growth exceeded expectations, inflation cooled faster than anticipated and all major asset classes except energy staged a dramatic end of year rally to finish in positive territory.

- Heading into 2023, we face a much different backdrop. While geopolitical risk remains quite high, sentiment has shifted to a much more upbeat mood. Recession fears have been replaced with soft landing optimism.

- We don’t portend to know what lays ahead in 2024. We recommend sticking close to long-term targets with a diversified portfolio and see this as one of the best strategies for the year ahead.

2023 Recap and 2024 Outlook

We are not big believers that the turn of the year ushers in a new regime or new abilities to forecast the future, but what a change the turn of the year has made recently.

At the end of 2022, investors and economists were deeply pessimistic. Stocks had just suffered their worst year since 2008 and bonds suffered some of their worst losses ever. A blended portfolio of 60% stocks and 40% bonds suffered its worst performance since 2008. In many ways 2022 felt worse than 2008 as nearly all assets save for cash and energy fell. Many investors called the 60/40 mix dead and hailed cash as king. Consumer sentiment, CEO confidence and investor bullishness all hovered at or near thirty-year lows. Most economists predicted that a recession, or even worse stagflation (a recession with high inflation) was imminent. Even the Federal Reserve projected the economy would grow at just 0.5% in 2023 with 3.5% core inflation and 4.6% unemployment.

Despite (or perhaps because of) all these 2022 worries and a new list of 2023 concerns, markets roared back with nearly all asset classes save for energy registering strong positive returns. 2023 started strongly for all assets then quickly gave way to fears around the banking crisis. Markets then rallied strongly in Q2 driven by AI enthusiasm, only to reverse course from August to October as inflation, recession and war fears returned. Finally, in November and December, markets staged a dramatic rally as investors began pricing in Fed rate cuts, an end to high inflation and a soft landing.

By yearend, the S&P 500 was up 25+%, the broad US bond market gained 5+%, and the 60/40 portfolio returned from the dead to deliver its second-best year in a decade. Consumer sentiment, buoyed by a strong job market and cooling inflation, recently registered its largest two-month increase in over thirty years and sits at the optimistic levels we saw in late 2021. Investor sentiment is also back near the ebullient levels seen in late 2021. CEO confidence has rebounded with authorized stock repurchases nearing all-time highs. In projections just made on December 13th with much of the year in the rearview window, the Fed updated their 2023 economic growth forecast up to 2.6% and its core inflation forecast down to 3.2%. They still got it wrong with 2023 economic growth coming in at 3.1% and inflation ending at 2.9%. The fears of recession and stagflation have now largely been replaced with hopes of a soft landing.

In terms of 2024, we think the above commentary should drive home one key point. 2022’s dramatic decline and 2023’s largely unpredicted rebound speaks to the importance of having a long-term plan in place. At the end of 2022, we noted that neither we nor all the economists at the Federal Reserve have a crystal ball for markets, inflation, or geopolitics. We urged investors to avoid the siren song to hoard cash, to stay lashed to the mast of their long-term strategic goals, and to grow their capital long-term by seeking out volatile but productive assets at attractive yields. In the face of significant uncertainty ahead, we continue to stand by this advice and remain very close to our long-term targets. We believe a diversified portfolio is one of the best strategies for 2024 which has already and will continue to bring its share of surprises.

Cash

We entered 2023 overweight cash but were focused on using excess cash to buy assets at attractive yields. As noted below, we did put some of our cash to work in various areas but remain slightly overweight. Cash still yields over 5% which is better than the yield we receive in lending to the United States for 10 years at 4.1% or 30 years at 4.3%. The issue with the 5% yield on cash is we don’t know how long that yield will last. Market participants predict the Federal Reserve will cut interest rates five times and that by yearend cash will yield ~4%. The Federal Reserve, who has certainly gotten this very wrong before, expects just three cuts and for yearend cash rates to be near 4.5%. In sum, even predicting future cash returns is not as easy as it might seem. While we are happy earning a 5+% yield today with a bit of excess cash, we continue to seek higher yields elsewhere.

Bonds

We entered 2023 underweight investment grade municipals, corporates, and Treasurys, but were more positive on high yield corporates and municipals. This turned out to be directionally right as high yield corporates gained 13+% and high yield municipals gained 9% with added tax benefits. Both these markets topped cash returns of 5%, while their investment grade municipal and corporate peers delivered roughly 5% but with a lot more volatility than cash.

We did start moving more toward neutral on investment grade bonds in Q4 as the 10-Year approached an attractive 5% yield but were surprised at how quickly investors turned from inflation and debt fears to soft landing and optimism for Fed cuts with yields plummeting below 4% by yearend. Economic data in 2024, including retail sales and employment, has come in a little better than expected pushing yields back to levels that are more attractive. We, along with the Fed, and the other holders of over $8 trillion of money market cash, will be closely watching the Treasury’s next debt issuance schedule along with revised inflation data in the weeks ahead.

The US continues to run some of its largest deficits at very low levels of unemployment and to date has racked up $33 trillion in debt. While we recognize that Treasurys may act as a haven should these long held recession fears materialize, we remain underweight and prefer government backed mortgages for taxable accounts where we can earn an additional 1.5% of yield for what we see as similar credit risk.

For taxable investors, we are relatively neutral to investment grade municipals now where we can earn roughly 5% on a tax-equivalent basis. Municipal finances largely continue to be on stronger footing than federal finances and the tax benefit of municipals may become more valuable should taxes rise to curb our debt. We also continue to like and to hold high yield corporates and high yield municipals at 7+% tax equivalent yields.

US Equities

We began the year underweight US equities, moved closer to our targets in 2023, but remain slightly underweight with a goal to close this gap on weakness. While we are sticking very close to our targets, we do see a few reasons to be slightly cautious, especially on large cap US equities. S&P 500 valuations recently touched 20x next years’ expected earnings, 24x last year’s earnings and 31x their last ten years’ earnings. These are some of the richest valuations on both an absolute level and relative to other assets like cash in twenty years. Sentiment has also recently turned from bearish to bullish. Both these factors tend to suppress future returns.

Finally, while sentiment has also turned from recession certainty to soft landing optimism, we still see numerous recessionary indicators. Soft landing mentions in the press, which have surged recently, are ironically associated with higher recession probabilities. The inverted yield curve, with cash yields above longer-term bond yields, is also associated with recessions. Bank lending remains restrictive, private lending remains expensive, and bankruptcies have pushed higher. All these conditions are associated with recessions as well. For these reasons, we are holding a bit of excess cash and are eyeing small and mid-cap US equities at cheaper valuations.

International Equities

Like US stocks, we entered the year underweight international shares, added to our exposure throughout the year and benefitted from their 15% return. We remain slightly underweight international stocks even as they trade near their historic lows on valuations. Broad international markets trade at their cheapest values relative to US stocks in over twenty years at 13x next years’ earnings. However, international stocks have traded at a discount to their US peers since 2009 and the gap has only widened. We think the US has numerous distinct advantages over their international peers that warrant some premium. This includes rule of law which aids dollar supremacy and innovation, a large homogenous society, vast and abundant natural resources and two ocean barriers for trade and defense. Furthermore, while the US skirted a 2023 recession, parts of Europe, including its powerhouse Germany, may already be in one. German home prices fell 15% in real terms, unemployment rose toward 6%, and industrial production has declined for six months.

German and European economic activity continues to be impacted by both the ongoing war in Ukraine and by the relative weakness out of China which has faced its own issues. Chinese shares also trade near historic lows. Just as investors were pessimistic and wrong about the US heading into 2023, they were generally optimistic and wrong on China in 2023. While China emerged from its zero-covid lockdowns in late 2022, consumer sentiment and foreign investor appetite remained weak as Xi Jinping continued to push policies that seemed to roll back China’s past moves toward freer markets. Xi remains a contradiction as China likely needs the world and foreign capital and thus freer markets to continue its path to prosperity, but he also covets Taiwan. While we can envision a path to a world with less strife and more prosperity, we don’t mind holding a bit of excess cash in case the world moves toward more chaos.

Alternative Assets

Most alternative assets failed to match the strong returns of global stocks.

We held a small overweight to uncorrelated hedge funds heading into 2023. We were generally pleased with our uncorrelated fund’s ability to deliver solid returns with just one small down month in a year where both bonds and equities were highly correlated, prone to whipsaws and periodic losses. We reduced our

overweight throughout the year but remain overweight. We think uncorrelated hedge funds that can truly make money no matter what allow most investors to stick to and add to riskier assets when unexpected shocks occur.

Directional hedge funds underperformed global equities and struggled on a few fronts. First, global equities were driven by a handful of shares with the “Magnificent Seven” contributing to the bulk of the year’s gains. Hedge funds generally did not hold these seven names in size. Next, hedge funds, and particularly global macro hedge funds, were hit by the whipsaws in the market. Global macro funds attempting to predict the near-term failed and ended the year with low and volatile returns. We continue to de-emphasize directional hedge funds focusing on a handful of specialized funds we think can drive alpha by being an inch wide and a mile deep.

Private capital was probably the biggest disappointment for investors in 2023. Private equity firms struggled to sell their existing assets given tight liquidity and a lack of appetite for IPOs, especially at yesterday’s prices. Private equity firms were also slow to put new capital to work in an arguably attractive environment. This is often the case with private equity firms freezing new investments during chaotic times. This left private capital with oddly both a record amount of unrealized value on their books and committed, undrawn capital or dry powder to put to work. Furthermore, while private equity firms were slow to mark down their unrealized values in 2022, they generally began these write downs in 2023 in earnest. While we are still awaiting final 2023 marks, we expect the year to be rather disappointing in terms of returns, realizations and activity. On a positive note, the overall freeze in private capital activity creates an opportunity for new investments and partnerships. We are seeing a tremendous amount of quality deal flow but can be patient and choosy. This is extremely important when making long-lived investments.

Finally, turning to real assets, 2023 was quite a mixed picture. As noted earlier, energy was the only major asset class that registered negative returns on the year. This occurred despite OPEC production cuts, an ongoing war in Ukraine and a new war in Gaza. Both wars could draw in additional players at any time. We have been surprised by the weakness in energy and continue to allocate capital toward sustainably and responsibly sourced production in the US. We see this as a strong stand-alone opportunity and as a hedge against further inflation surprises and geopolitical risk.

Gold fared better in 2023, up 13+% and importantly it was one of the only assets that was lowly correlated. We continue to hold a small gold allocation and believe it too can serve a purpose in a world where strife and distrust grow.

Real estate had a mixed and volatile 2023. On the private side, we finally saw prices coming down toward public market valuations and facing the same questions and concerns as private capital above. Publicly traded real estate was one of the most volatile sectors on the year. The broad index was off -11% toward the end of October, but then jumped 23% to close the year up 10%. Office REITs were the poster child of this volatility. Off -26% through October, they jumped 33% in the yearend rally to close the year flat. We still think there is more trouble for office space and prefer more specialty real estate like farmland, industrial warehouses, housing, data centers and cell towers. We are spending a considerable amount of time studying what AI means for data centers and their need for power.

Conclusion

In conclusion, 2023 was chaotic, prone to whipsaws and full of concerning headlines, but investors who stuck with their long-term plan were rewarded. We wish, like all investors, that we had a crystal ball for the year ahead, but we do not. We think sticking close to long-term targets with a bit of added caution and liquidity makes sense as we head further into 2024. As always, we will be looking for attractive opportunities at solid yields especially during inevitable bouts of fear.

Source: Factset

This material is published solely for the interests of clients and friends of Sentinel Trust Company, L.B.A. and is for discussion purposes only. The opinions expressed are those of Sentinel Trust Company management and are current as of the date appearing in this material and subject to change, without notice. Any opinions or solutions described may not be suitable for investments nor applicable to all scenarios. The information does not constitute legal or tax advice and should not be substituted for a formal opinion. Individuals are encouraged to consult with their professional advisors.

The material is not intended to be used as investment advice, nor should it be construed or relied upon, as a solicitation, recommendation, or any offer to buy or sell securities or products. Any offer may only be made in the current offering memorandum of a fund, provided only to qualified offerees and in accordance with applicable laws. Each type of investment is unique. This material does not list, and does not purport to list, the risk factors associated with investment decisions. There can be no assurance that any specific investment or investment strategy will be profitable and past performance is not a guarantee of future investment results. Before making any investment decisions, you should carefully review offering materials and related information for specific risk and other important information regarding an investment in that type of fund.

Information derived from independent third-party sources is deemed to be reliable, but Sentinel Trust cannot guarantee its accuracy of the assumptions on which such information is based.