Todd Burchett and Sentinel Trust’s Investment team review the markets in 2022 and discuss 2023 outlook.

Please read the full text below or download the PDF version.

Executive Summary

- 2022 was a difficult year in many ways. According to the U.N., Russia’s invasion of Ukraine has caused an estimated 18,000 civilian casualties and another seven million Ukrainian refugees to flee the country. Essential commodity prices like Brent Crude Oil jumped over 75% in Q1 stoking already hot inflation further toward 10% globally.

- Faced with the harsh reality that inflation may no longer be pandemic driven and transitory, the Federal Reserve and their global central bank peers abruptly reversed course. At the outset of the year, the Fed was adding $15B of cash with no yield to the markets each month to promote the post-pandemic recovery. By year end, the Fed was pulling $90B of cash yielding nearly 4% from the markets to cool inflation.

- In short, in 2022 cash moved from trash to king and nearly all other asset classes suffered. Below we will discuss how we navigated 2022 and our plans for 2023.

2022, The Federal Reserve, Cash, and Inflation

We entered 2022 overweight cash noting that with unemployment at 4% and inflation near 7% the Fed had achieved its full employment mandate but was well behind its inflation mandate. The Fed unexpectedly and aggressively hiked cash rates from 0% to 4.5% in 2022 but may still have more unexpected work to do. US unemployment has fallen to 3.5% and jobs remain plentiful. While inflation has subsided recently, it remains uncomfortably high at 7% and well above the Fed’s target.

While the Fed, consumers and market participants all expect inflation to cool further, inflation historically has been one of the most difficult numbers to predict. It can be impacted by the Fed, but it is also driven by billions of consumers and suppliers. We are seeing supply chain bottlenecks curing and interest sensitive goods prices from used cars to houses and furniture falling, which helps. However, the US consumer remains relatively strong with an excess of $1 trillion dollars of savings. Consumption has recently shifted away from goods to services which requires more labor in an already tight job market.

Fed officials are worried about a wage price spiral that leads to persistently high inflation. Global events from the war in Ukraine, to increasing distrust and deglobalization, to the recently unleashed Chinese consumer threaten to push inflation higher still. We’ve met with many past and present Fed officials who all are humbled when predicting inflation. Paul Volcker, the Fed Governor often credited with squashing inflation forty years ago, noted: “I suppose if some Delphic Oracle had whispered in my ear that our policy would result in interest rates of 20 percent or more, I might have packed my bags and headed home. But that option wasn’t open… (W)e were ‘lashed to the mast’ in pursuit of price stability.”

Jerome Powell, the Federal Reserve, and their global central bank peers are for now in a similar situation. They are hopeful that inflation is subsiding, humble enough to understand it is highly unpredictable, but determined to bring back price stability. The Fed hopes hiking cash rates to 5% in 2023 and holding there will kill inflation. The market for now thinks this 5% will be too much and that the Fed will in fact be cutting rates later in 2023 to stave off the most predicted recession of all-time. Given the humbling nature of predicting inflation, we must also consider the risk that the Fed may need to go beyond or perhaps well beyond 5% to quell inflation. For this reason, we remain overweight cash in the near-term.

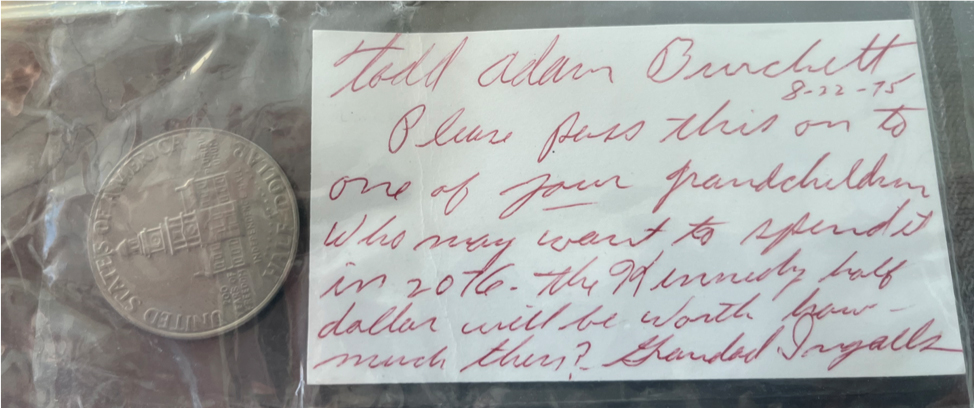

Long-term, we recognize cash is unproductive. Historically and currently it often yields less than inflation before taxes. We must therefore seek productive inflation topping yields elsewhere. In 1976 for America’s bicentennial, my grandfather gave me a Kennedy half dollar with inflation at 12%. He left a note wondering what it would be worth in 100 years. I’ve kept it and it’s still worth just fifty cents but now buys me just ten cents worth of goods in 1976 terms. If I’d invested it in productive assets like the S&P 500, I estimate it would be worth $68 today and buy me $13 worth of goods in 1976 for a 25X real return on my money. This occurred despite the early 1980s double dip recession, the Cold War, 9/11, the 2000 tech bubble, the 2008 Great Financial Crisis, the pandemic and current bear market.

The 2022 bear market was doubly painful psychologically. Stocks recorded their worst losses since 2008. Bonds, which typically rise when stocks fall, suffered their worst loss since the 1780s. These are painful losses and can increase the siren song to hoard cash to “preserve wealth.” Even back in 1776 though, Adam Smith noted that wealth is not measured in silver and gold, but rather the stream of goods and services one creates, or in other words, the share of productive assets one owns. While portfolios lost value last year, we think we generally maintained or grew our share of productive assets. In 2023, despite heightened risk, we will continue to focus on growing our share of productive assets at attractive yields.

2023 Outlook- Searching for Productive Assets with Inflation Topping Yields

Generally, investors first look to longer-term bonds to earn yields above inflation, but today the outlook is mixed. Whereas we can earn close to 5% pre-tax by lending to the US for six months, our yield falls to below 4% for ten- and thirty-year loans. This is an inverted yield curve where investors demand less yield for longer loans despite America’s current and past inflation. Investors appear to be willing to accept a lower yield on longer loans as they believe the Fed will soon need to reverse course and cut cash rates well below 5% to stave off an impending recession. While we remain open to this possibility, we think it is very consensus and contrary to Jerome Powell’s repeated assertions that he will do what it takes to quell inflation. We remain underweight most taxable bonds and generally remain unwilling to loan new money to the US long-term at rates well below inflation.

We also remain underweight tax-exempt municipal bonds but are a bit more optimistic on the space. Whereas the Treasury curve is inverted, the municipal bond curve is much steeper with investors generally receiving some inflation premium for lending over longer time periods. While the US government and many of its international peers have large and growing debt issues, municipals are quite strong with record tax receipts and rainy-day funds. We are particularly attracted to lower grade, but higher yielding municipals and continue to find opportunities to earn tax-free yields north of 5% on loans to productive public assets like schools, hospitals, and roads.

We are also finding some attractive opportunities in taxable, high yield corporate bonds. Loans to high yield or riskier corporate issuers still yield close to 9% pre-tax. While we should expect more defaults and potentially even higher yields on offer in a recession, we believe our active managers can navigate this and find truly productive companies that can service their debt in good times and bad.

Turning to US equities, the next leg out on the risk spectrum, we also see a bit of a mixed picture. While the larger cap and more tech focused S&P 500 fell nearly 20%, valuations are still not historically cheap. The S&P trades at roughly 17X next year’s expected earnings or at roughly a 6% yield which is not a large premium above current or potential cash rates. Furthermore, while most investors and economists are predicting a recession in 2023, 2023 earnings expectations have only fallen about 5% versus the 20+% decline in earnings we typically see in a recession. For now, we prefer profitable mid and small cap US shares which trade closer to 14X next year’s earnings and will seek to grow our ownership of such shares during bouts of fear and pessimism as we did in September.

International stocks are exceptionally cheap, but as we’ve noted before we think this is for good reason. The MSCI All Country ex-US index trades at a historically cheap 12X estimated 2023 earnings for a solid 8% yield, but this comes with many risks. Russia’s war with Ukraine continues with Vladimir Putin’s rhetoric and options growing more desperate. Europe continues to struggle with a unified response to the war, inflation, and energy security. Japan continues to struggle with an aging populace and its own unorthodox monetary policy that left the Bank of Japan owning roughly half of Japan’s debt at artificial borrowing rates. China appears to be re-emerging from an ugly 2022 authoritarian lurch with a pragmatic approach to the economy, but tensions with the US remain high. In short, we are attracted to the valuations of productive companies internationally and are more likely to add on weakness but are maintaining a cautious and underweight approach for the time being.

Alternative Assets

Turning to alternative assets, we remain generally optimistic and overweight, but highly selective. We’ve noted repeatedly that hedge funds are not an asset class, that the space is rife with unattractive, illiquid, and high-fee partnerships, but that there are a handful worth the hurdle. We found this to be the case in 2022 with our uncorrelated funds able to deliver positive returns in a market that delivered very few winners. Amidst the uncertainty and volatility, we believe the role of truly uncorrelated funds that seek to make money no matter what through manual efforts is growing. While our more directional hedge funds lost value in 2022, they’ve weathered the storm relatively well capturing roughly half the downside seen in global equity markets. Moving forward, we believe our select group of managers here are well positioned to find attractive productive assets in specialized opportunity sets such as energy and the energy transition, biotechnology, and emerging technology capable of delivering strong future cash flows.

Our highly selective focus carries over into venture capital, traditional private equity, and real estate where we see an exciting opportunity set. The end of free money from the Fed has likely brought an end to the spray and pray approach in private markets that led to higher valuations and record deals with scant due diligence. While many other allocators are struggling with bloated private capital portfolios with a murky path to liquidity, we’ve always focused on vintage year diversification, preserving dry powder and planting trees across time. The highest returns from private capital most often stem from liquidity droughts, recessions and bear markets and we think now is a great time to be leaning into privates.

Ending with hard assets, real estate, and commodities, we remain relatively optimistic and selective. We own a small position in gold despite its lack of cash flow as a small hedge against rising global mistrust. We think real estate in the public markets is on sale, especially in certain areas like multi-family housing. On the more illiquid side, we continue to like the cash flow generated by American farmland. We also continue to focus on acquiring smaller industrial and self-storage opportunities, professionalizing them, and selling them to the larger players. Finally, we continue to like the opportunity set in energy and plan to use the current pullback and any recession fears to acquire more productive assets in the space. While we invest in and follow the energy transition closely, we believe the world will continue to need oil and natural gas for some time to come, that new investments have dried up and that we can help provide the cleanest and safest fuel to a world in need.

Conclusion

As always, neither we nor Jerome Powell have a crystal ball for markets, inflation or geopolitics heading into 2023. We see plenty of risk, but more and more attractive assets delivering yields above inflation. We will use the excess cash we raised in 2021 and 2022 to increase our share of these assets for the long-term. Just as Volcker was lashed to the mast to quell inflation, as long-term investors we too are lashed to the mast by our long-term strategic goals of preserving and growing our capital by investing in volatile but productive assets with attractive yields.

This material is published solely for the interests of clients and friends of Sentinel Trust Company, L.B.A. and is for discussion purposes only. The opinions expressed are those of Sentinel Trust Company management and are current as of the date appearing on this material and subject to change, without notice. Any opinions or solutions described may be not be suitable for investments nor applicable to all scenarios. The information does not constitute legal or tax advice and should not be substituted for a formal opinion. Individuals are encouraged to consult with their professional advisors.

The material is not intended to be used as investment advice, nor should it be construed or relied upon, as a solicitation, recommendation, or any offer to buy or sell securities or products. Any offer may only be made in the current offering memorandum of a fund, provided only to qualified offerees and in accordance with applicable laws. Each type of investment is unique. This material does not list, and does not purport to list, the risk factors associated with investment decisions. There can be no assurance that any specific investment or investment strategy will be profitable and past performance is not a guarantee of future investment results. Before making any investment decision, you should carefully review offering materials and related information for specific risk and other important information regarding an investment in that type of fund.

Information derived from independent third-party sources is deemed to be reliable, but Sentinel Trust cannot guarantee its accuracy or the assumptions on which such information is based.